It’s a most conversable topic in the environment and material compliance space; In 2010, US Congress passed the Dodd-Frank Act, with rules requiring SEC listed companies to disclose their use of conflict minerals viz., Tantalum, Tin, Tungsten or Gold (3TG).

The purpose of the rule was to keep a check on exploitation and trade of conflict minerals by armed groups is helping to finance conflict in the DRC region and is contributing to an emergency humanitarian crisis.

Starting January 2021, a new law will apply across the EU – “the Conflict Minerals Regulation”

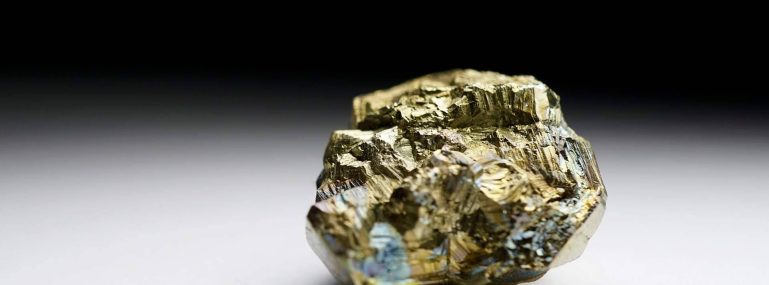

As the world’s biggest trading bloc, the European Union has a responsibility to contribute to fair, transparent and value-based trade. This is a big step in that direction. It aims to help stem the trade in four minerals such as Tantalum, Tin, Tungsten and Gold, which are used in the production of everyday products like mobile phones, cars and jewellery; which sometimes finance armed conflict or are mined using forced labor.

The structure of this guidance defines frameworks, policies, measures and supplements to determine due diligence processes for responsible supply chain of minerals from conflict-affected and high-risk areas, consistent with applicable laws and relevant international standards.

A Five-Step Framework:

EU importers will have to carry out checks on their supply chain by following a five-step framework, as defined in the ‘Organisation for Economic Co-operation and Development (OECD)’ guideline:

Inside and outside the EU

Indirectly, the regulation affects smelters and refiners of Tantalum, Tin, Tungsten and Gold, both inside and outside the EU. This is because EU importers of minerals and metals will need to make sure they source from responsible smelters and refiners i.e.; the regulation focuses on conflict minerals from all “conflict-affected and high-risk areas” around the world. In this way, the EU regulation is different from the US rule, which focuses on conflict minerals only from the Democratic Republic of the Congo and adjoining countries.

For “upstream” companies who import raw materials to smelting and refinery plants in the EU. This covers the vast majority of such metals and minerals imported to Europe. The particular needs of small companies will be catered to so as to avoid subjecting them to overly cumbersome procedures, by exempting recycled minerals, and imports of very small volumes. For “downstream” companies, that use the refined forms of these metals and minerals in components and goods, the Commission will now carry out a number of measures. These include the development of reporting tools and standards to further boost due diligence in the supply chain, as well as setting up a transparency database. Those downstream operators who import refined, metal-stage products into the EU will be covered by the mandatory obligations. Through a review clause, there is also the possibility for the Commission to propose further mandatory obligations for the downstream supply chain if deemed necessary.

Third party report

In addition to the framework, companies are also required to provide third-party audit reports on smelter and refinery diligence practices. They must identify and assess the risks of adverse human rights impacts in their supply chains. Importers that pursue risk mitigation efforts as they continue to trade with, or even if they temporarily suspend trade with, certain suppliers are required to consult with suppliers, government authorities, civil society organizations, and other third parties on a risk mitigation strategy.

How do you ensure compliance?

One of the key challenges that companies face today is huge gap in supply chain traceability and related documentation, which is critical to make the compliance assessments and declarations. The Supplier base is today not able to deliver the required compliance data, such as Certificates of Compliance or Material Source information, which is critical for a legitimate compliance program.

Enventure is today a leader in the compliance space, providing a host of solutions that enable customers to meet their regulatory compliance obligations. With services ranging from Consulting to Gap Analysis to Training and Data Collection, Enventure is able to provide comprehensive solutions, which are tailored to customer specific needs and priorities.

Our unique ability to handle standard off-the-shelf parts, as well as custom parts sets us apart from the competition and makes the parts coverage best in class, since 2003, Enventure has assisted over 600 global corporations in fulfilling their regulatory & environmental compliance requirements within stipulated timelines, and with high levels of cost efficiency. Our customers include OE Manufacturers, Contract Manufacturers, as well as Distributors and Retailers.